Virtual or electronic money PAIR à PAIR, for example BITCOIN

When was the first time you came across the term « bitcoin »?

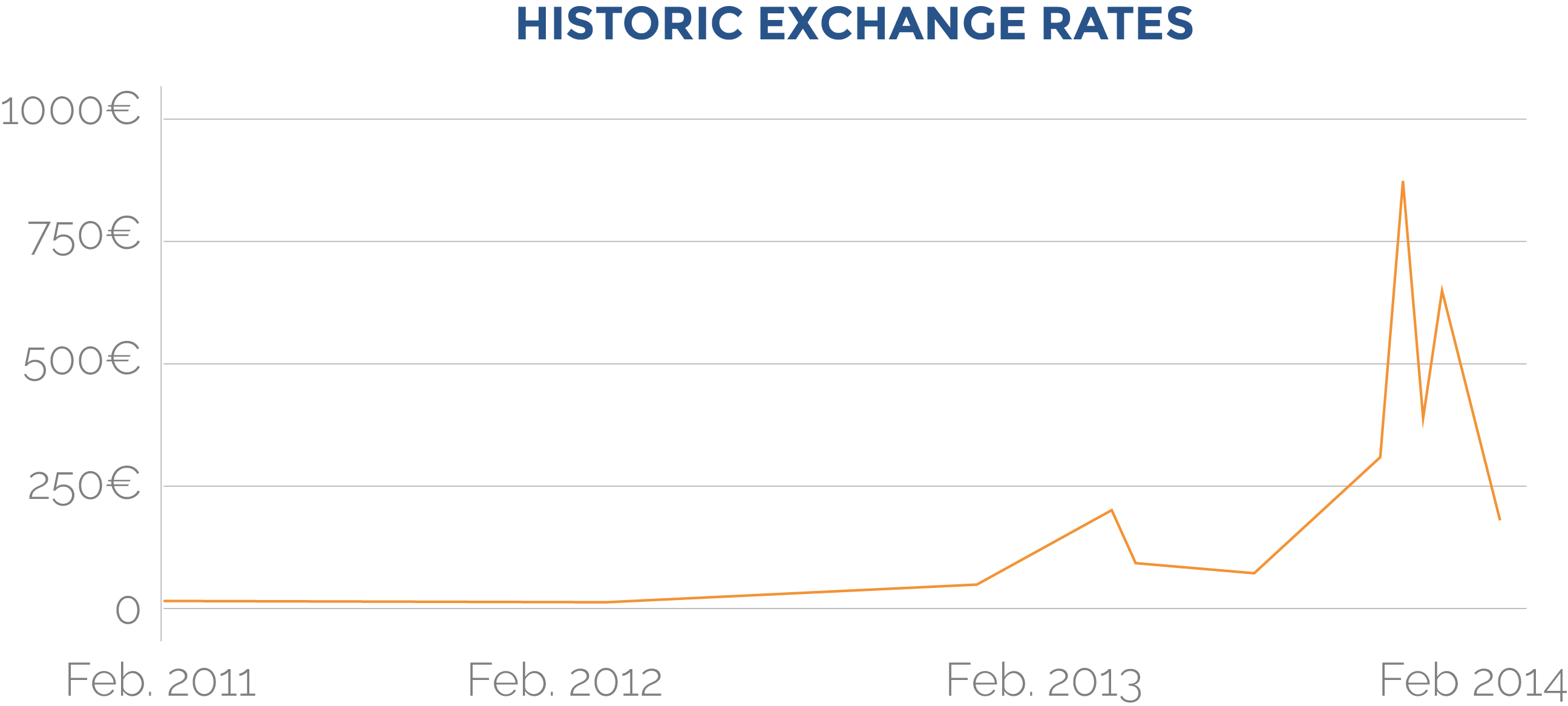

- 11 April 2013 : the value of the bitcoin dropped from 266 to 105$ and settled at 160$ in less than 6 hours.

- 5th of December 2013 : The central chinese bank prohibited all local banks from all transactions using Bitcoin.

- 11th February 2014 : Bitcoin trading platforms were massively under attack.

- 24th of February 2104 : The managing director of the main platform Mt Gox, resigned from the Bitcoin foundation. From Mid february onwards, following the discovery of a bug, cash withdrawals were suspended. On the 25th of February, Mt. Gox’s website was a blank page…

What is Bitcoin?

- Electronic money « pair à pair » and decentralised, works thanks to its users, without a central authority or intermediary.

- Validation of transactions and generation of money based upon the principles of cryptography.

- Payment system without a centralised infrastructure taking into account amounts held in order to ensure the transactions.

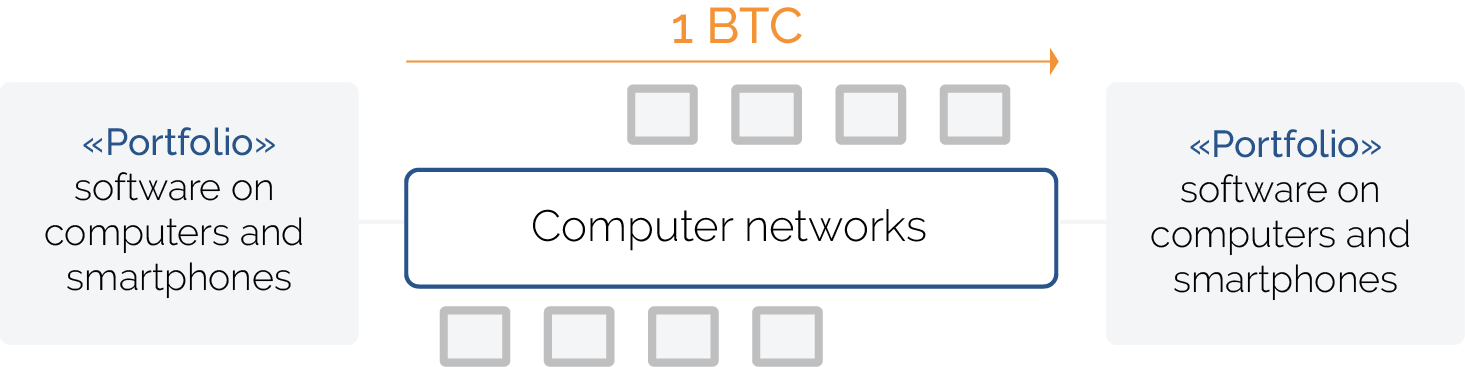

Function

- The software provides a personal portfolio allowing a user to send and recieve Bitcoins.

- The network shares a large accounting book named « block chains ». It contains each processed transaction allowing a users computer to verify the validity of each transaction.

- the mining: anyone can process transactions by using the computing power of specialized equipment and earn a return reward for this service.

Advantages

- Send and recieve any sum of money instantaneously, anywhere in the world at any time.

- Payments using BITCOIN are currently handled for free or at a very low cost. BITCOIN transactions are secure and irreversible.

- BITCOIN payments are carried out without any personal information linked to the transaction.

Risks

- High volatility and low adoption levels. No legal guarantee for refunding at any time and at the nominal value.

- By its own self, Bitcoin promotes the bypassing of rules related to the struggle against capital money laundering and the financing of terrorism.

- An important legal risk related to its status of being a non regulated money.